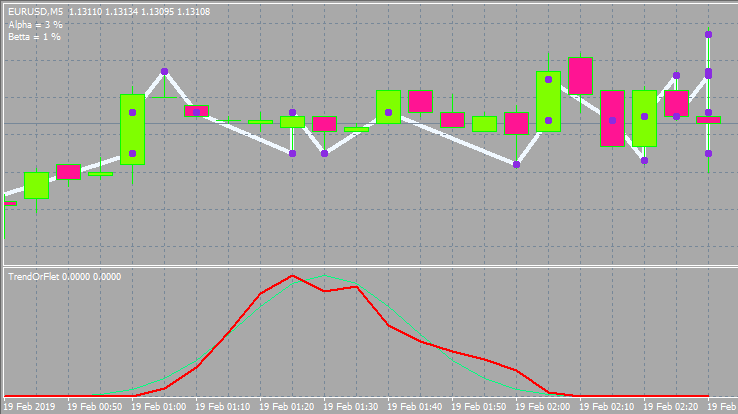

26/05/ · The Maths Behind Successful Forex Trading In Lesson 6 of the Infinite Prosperity Course, you would have downloaded the Infinite Prosperity: Probability Calculator. For the sake of this short post, let’s set aside any technical, fundamental or mechanical trading elements, and talk purely about probability and blogger.comted Reading Time: 2 mins 16/11/ · Value Of One Pip = ( / Current Exchange Rate) * Trade Size. If you want to trade the EUR/USD with its current exchange rate of and a contract size of 1 standard Lot ($), you can calculate the pip value as follows: Value of one pip = ( / ) * $ = blogger.comted Reading Time: 10 mins 08/12/ · In case of chaotic trading, PrF = 1 provided that the spread is equal to zero again. M and PrF are two values that are quite sufficient to evaluate the strategy from all sides. In particular, there is an ability to evaluate the trend or flat nature of a certain instrument using the same probability theory and combinatorics

The Maths Behind Successful Forex Trading - Infinite Prosperity | Infinite Prosperity

May 26, 3 Minute Read. In Lesson 6 of the Infinite Prosperity Course, you would have downloaded the Infinite Prosperity: Probability Calculator. You can see that in the curve. Do the numbers. In other words, your EURUSD long and USDCHF short position are correlated through the USD. This fact can elongate the consecutive loss figure produced by this random number generator. In English: You can, and most likely will, in practice of this particular edge, lose even more than 10 trades in a row at some point!

Can you see why most people who try, never actually become professional traders? By the time they get to trades with zero net performance discrepancy, they usually transcend their initial mechanical strategies and move into a more advanced trading routine. These are the numbers!

This is not our opinion, preference, style or taste. Sure, we have our own style as well, but trading style must always be developed around the universal laws. Maths and probability do not and will not bend around your trading style or expectations.

Copyright © Infinite Prosperity Australia Pty. Disclaimer Privacy Cookie Policy. Speculative trading in particular has large potential rewards, mathematics behind forex trading, but also large potential risks.

Before deciding to trade, you should carefully consider your objectives, financial situation, needs and level of experience. You mathematics behind forex trading be aware of all the risks associated with trading on margin. Infinite Prosperity provides general advice that does not take into account your personal and individual objectives, financial situation or needs.

The content of this website must not be construed as personal advice. The possibility exists that you could sustain a loss in excess of your initial investment, and therefore, you should not trade with capital that you cannot afford to lose, mathematics behind forex trading.

If you have any doubts or concerns, Infinite Mathematics behind forex trading recommends you seek advice from an independent financial advisor. Please do not trade with borrowed money or money you cannot afford to lose, and keep in mind that past performance is no indication of future results. Enroll Reviews About Us Blog Community Login. lewis May 26, 3 Minute Read. Day TradingSwing Trading.

The Maths Behind Successful Forex Trading In Lesson 6 of the Infinite Prosperity Course, mathematics behind forex trading would have downloaded the Infinite Prosperity: Probability Calculator. Connect with:. Sign In with Facebook. This comment form is under antispam protection. Notify of. new follow-up comments new replies to my comments. Popular Articles Sorry. No data so far. Categories Finance Mindset Day Trading Swing Trading Team Business, mathematics behind forex trading.

Popular Tags Forex goal setting infinite prosperity Infinite Prosperity Ball Investing mindset Passive Semi-Passive Technical Analysis Trading.

7 Trading PSYCHOLOGY \u0026 DISCIPLINE Rules to Deal with Losses (The Winning Mindset of a Trader)

, time: 10:20Essential Math Guide for Forex Traders - Forex Training Group

26/05/ · The Maths Behind Successful Forex Trading In Lesson 6 of the Infinite Prosperity Course, you would have downloaded the Infinite Prosperity: Probability Calculator. For the sake of this short post, let’s set aside any technical, fundamental or mechanical trading elements, and talk purely about probability and blogger.comted Reading Time: 2 mins 16/11/ · Value Of One Pip = ( / Current Exchange Rate) * Trade Size. If you want to trade the EUR/USD with its current exchange rate of and a contract size of 1 standard Lot ($), you can calculate the pip value as follows: Value of one pip = ( / ) * $ = blogger.comted Reading Time: 10 mins 08/12/ · In case of chaotic trading, PrF = 1 provided that the spread is equal to zero again. M and PrF are two values that are quite sufficient to evaluate the strategy from all sides. In particular, there is an ability to evaluate the trend or flat nature of a certain instrument using the same probability theory and combinatorics

No comments:

Post a Comment