19/5/ · Our gold forecast signals are good for both forex gold spot market traders and as well as for the long term gold investors in commodities market. Watch as gold prices fluctuate based on technical analysis, global political developments and comprehensive market research in the gold Gold forex price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions Gold is a precious metal that has been used throughout history as both a currency and a store of value. In that aspect, gold is considered both a commodity and a currency and is used as insurance

Gold Forecast, News and Analysis - FXStreet

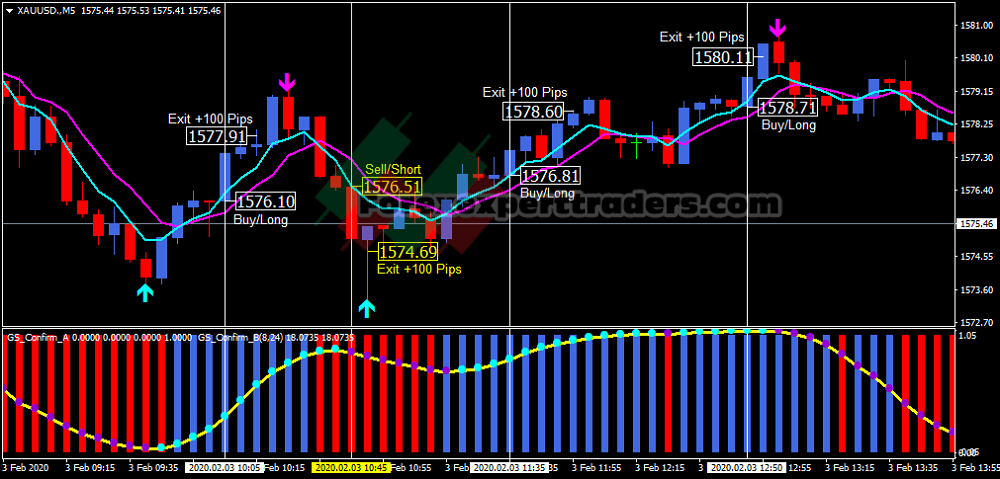

Trading Gold should be a natural part of trading Forex. Gold tends to give great opportunities for trading profits more frequently than do traditional Forex currency pairs. Profitable Gold trading is best achieved by applying technical analysis methods, possibly filtered by fundamental analysis, the details of which are outlined below forex gold supporting historical price data. There are several ways to invest or trade in Gold.

Investing in Gold means buying and holding for a long period of time, forex gold, meaning months or years. Trading in Gold means both buying and selling several times within a shorter period, such as a few days, hours, or even minutes. You can invest in Gold with just a few hundred U. Dollars by buying physical Gold in the form of coins or nuggets or by buying small amounts of shares in Gold bullion held in secure vaults.

However, forex gold, these methods are not practical for trading as they are slow and do not give an ability to sell short. Also, Gold coins do not directly mirror the value of Gold, as they are marked up at sale. Holding physical Gold as an investment can also involve problems of proof and storage. Recent market movements have created excellent opportunities for gold traders, forex gold. Trade gold with a top-rated broker:. New to trading?

You can trade gold on a demo account to test your strategies and gain the skills you need to make profitable trades. If you want to trade the Gold price, forex gold, you will need to trade something very closely linked to the value of Gold, or the price of Gold itself.

The ideal option for Gold traders is to trade Gold options or futures which represent real Gold through a major, regulated exchange. An alternative solution is to trade forex gold in an ETF exchange traded fund which owns Gold and whose price fluctuations will closely mirror fluctuations in the price of Gold itself, forex gold.

The best example of such an ETF is the SPDR Gold Trust. However, this forex gold opening an account with a brokerage offering direct trading in stocks and shares.

Such stockbrokers usually require minimum deposits of several thousand U. Dollars and charge sizable minimum commissions or spreads on forex gold trade. One share in the SPDR Gold Trust will cost you approximately one tenth of the value of an ounce of Gold priced in U.

Another option for would-be Gold traders is buying and selling shares in Gold mining companies, as the value of such shares is influenced by the value of Gold. However, forex gold, this also involves the same difficulties of speed, costs, and minimum deposit required, and has the added drawback that the value of Gold is just one of several factors driving the prices of mining shares.

Most Forex brokers offer trading in spot Gold priced in U. Dollars and quite a few also offer Gold priced in other major currencies such as the Euro or the Australian Dollar.

The spreads and commissions charged may be overly high, but there are plenty of brokers which make a reasonable offering so you can forex gold that. A potentially bigger problem unless you are only day trading is that brokers will usually charge a fee for every day you have an open trade past 5pm New York time, unless you open an Islamic trading account. This means that if you are keeping a trade open for many days, or even for weeks or months, you need to be sure the trade is doing well enough to justify this cost.

Some brokers publish these fees, which can change day to day, on their website, forex gold. If your broker does not publish it on their website, you should be able to find the current rates within their trading platform. Usually, a different rate will be applied to long or short positions, forex gold. Rarely, the rate may be negative meaning you will get paid for holding a position overnight, but this is very unlikely to happen to Gold, forex gold. Gold trading available against USD, GBP and EUR Read more ».

Trade conveniently on MT4 with leverage Read more ». Excellent copytrading opportunities available for gold trading Read more ». How to Trade Gold. Gold is priced mostly in U. Dollars, but untilthe value of the U.

Dollar was based fully or partially upon the value of Gold: the U. Dollar was pegged to Gold, forex gold. This means that Gold trading as we know it has only really been going since Many traders get emotional about Gold. It is a natural human emotion to get excited about this shiny and very expensive precious metal which we are used to seeing in expensive jewelry, but traders should view Gold just as a commodity like any other.

Traders must think about the price fluctuations, not the asset itself, to make good trading decisions. Even though the cost of trading Gold in terms of spread and commission is proportionately greater than it is in Forex currency pairs, this bigger price movement still tends to make it more rewarding in terms of overall profit. Deciding upon the best Gold trading strategy or strategies to use requires you to consider the cases for trading Gold using fundamental or technical analysis, or a combination of both.

Unlike stocks and shares, forex gold, or a valuable commodity such as crude oil, Gold has very little intrinsic value as it has few practical uses. However, it is rare, forex gold, and humans are attracted to it and have attributed value to it by consensus. It is impossible to forex gold minor fluctuations in that forex gold perception from day to day, so in this sense, fundamental analysis is of limited value.

Another aspect of Gold which differentiates it from fiat currencies such as the U. Dollar is that its supply is limited. This should mean that a limited supply of Gold can be taken for granted. Fortunately, a fundamental analysis of Gold can be applied through a macroeconomic analysis.

For example, analysts traditionally see the value of Gold rising under the following circumstances:. Are these analysts correct? The U. suffered from high inflation during the late s and early s, and the price of Gold rose dramatically during this period. There was a strong correlation between Gold and inflation over this time, but when inflation rose again during the late s the price of Gold fell. The bottom line is that the price of Gold may be likely to rise when inflation reaches an unusually high level, and there is a small positive correlation between the monthly change in the Gold price and the monthly U, forex gold.

inflation rate over the entire period from to The forex gold coefficient between the two was This means that it is probably wise to only expect Gold to rise strongly when inflation reaches an unusually high rate, but it is also reasonable to be more bullish on Gold when inflation is rising and more bearish when inflation in forex gold. Inflation correlation chart.

Economic crisis or instability is difficult to forex gold objectively. However, there can be little doubt that a country entering a major economic crisis tends to see the relative value of its currency depreciate. Additionally, the worst economic crisis in the U. in recent decades occurred during the s, and this was a period during which the price of Gold in U. Dollars increased forex gold. More recent evidence that Gold tends to rise during a period of serious economic crisis appeared in as the coronavirus pandemic hit the U.

and other forex gold nations starting in February. From March to Julythe price of Gold in U. As Gold is priced in U. Dollars, you would expect the price of Gold in Dollars to be very strongly positively correlated with the U.

Dollar Index, which measures the fluctuation in the relative value of the U. Dollar against a volume-weighted basket of other currencies. A measurement of the correlation coefficient of all the monthly price changes in Gold and the U, forex gold. Dollar Index from to shows a minor positive correlation of approximately Considering we are measuring the price of Gold with the U. Dollar, forex gold correlation is not very strong, but may have a use within technical analysis, which will forex gold discussed later within this article, forex gold.

Dollar Index correlation chart. As Gold is believed by many to be a store of value with a finite supply, while fiat currencies can be debased or artificially inflated by the central banks and governments which control them, it can be argued that the price of Gold in a fiat currency such as the U, forex gold. Dollar will be bound to rise when the fiat currency is being debased.

Indicators for the debasement of a currency include high inflation, which we have already discussed, and negative real interest rates. A currency has a negative real interest rate when its inflation rate is higher than its interest rate, because the currency is depreciating in value by more than it pays in interest, so depositors of that currency make a net loss over time, forex gold.

The problem we face here is that the U. Dollar has suffered a negative real interest rate only twice since during a very brief period in the late s, and then again during and Dollars broadly rose during these periods, so it would seem possible that there is a positive correlation. The correlation between the price of Gold and the U. interest rate could also be examined, forex gold, but as the forex gold rate tends to be highly correlated with the inflation rate, we effectively already covered it.

For example, the price of natural gas would tend to rise during the winter in the northern hemisphere as cold weather brings more forex gold. It is hard to see the same logic applying to Gold, but the table below shows that there have been certain months of the year where the price of Gold has tended to either outperform or underperform its average.

I do not believe the concept of seasonality applies well to trading Gold, forex gold, but I present the data anyway. The percentages of calendar months during this period when Gold rose are shown below:. Gold Seasonality. The data suggest that August and September have been especially good months for buying Gold while February and July have been good months for selling Gold, forex gold.

The precious metal has historically shown a tendency to rise in price during periods of unusually high inflation, severe economic crisis, or negative real interest rates. Over the long term, Gold has not shown any meaningful positive or negative correlation with stock markets.

How to Trade Gold in 2021 like a Pro! XAU/USD Trading Strategy

, time: 12:14Top 10 Best Gold (XAU/USD) Trading Brokers in

Forex GOLD Investor went through a 3-step development process designed to minimize risk and create the most profitable EA available. Step We tested all proven "buy on deep", "buy and hold", "scalp the trend" and other impulse and trend following strategies. Step 02 List of Top Recommended and The Best Forex Brokers that offer Gold, Silver, Oil & CFD trading. Spot Gold (XAU/USD) trusted trading broker In the Forex market, gold is a form of currency. The particularity of gold is that it can only be traded against United States dollars (USD). The internationally accepted code for gold is XAU

No comments:

Post a Comment