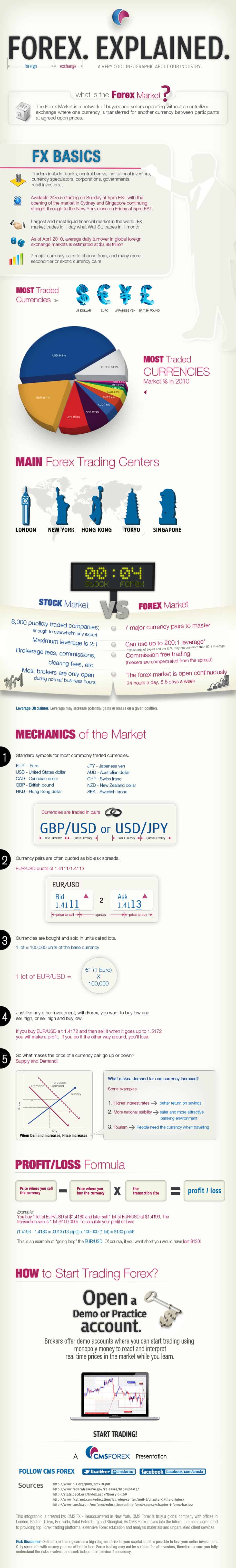

/12/20 · The foreign exchange market allows large institutions, governments, retail traders and private individuals to exchange one currency for another Estimated Reading Time: 8 mins In forex specifically, drawdown refers to a reduction of equity in your portfolio. No matter what trading strategies you use for forex, a drawdown is bound to happen sooner or later. Whenever your overall capital is reduced in the forex market, you are experiencing a drawdown Forex traders buy and sell different currencies 24 hours a day, 6 days a week, and access increased leverage (purchasing power) in order to speculate on global currency flows and market volatility. The Foreign Exchange market is commonly referred to as Forex or FX, and it is a worldwide, decentralised, over-the-counter financial market for the trading of currencies

Drawdown in Forex Explained (): What It Is, and What to Do ✅

FOREX — the foreign exchange market or currency market or Forex is the market where one currency is traded for another. It is one of the largest markets in the world.

Some of the participants in this market are simply seeking to forex explained a foreign currency for their own, forex explained, like multinational corporations which must pay wages and other expenses in different nations than they sell products in.

However, a large part of the market is made up of currency traders, forex explained, who speculate on movements in exchange rates, much like others would speculate on movements of stock prices. Currency traders try to take advantage of even small fluctuations in exchange rates. In the foreign exchange market there is little or no 'inside information'.

Exchange rate fluctuations are usually caused by actual monetary flows as well as anticipations on global macroeconomic conditions, forex explained. Significant news is released publicly so, at least in theory, everyone in the world receives the same news at the same time. Currencies are traded against one another. Unlike stocks and futures exchange, foreign exchange is indeed an interbank, over-the-counter OTC market which means there is no single universal exchange for specific currency pair.

The foreign exchange market forex explained 24 hours per day throughout the week between individuals with Forex brokersbrokers with banks, and banks with banks, forex explained. If the European session is ended the Asian session or US session will start, so all world currencies can be continually in trade.

Traders can react forex explained news forex explained it breaks, rather than waiting for the market to open, as is the case with most other markets. On major currency crosses, the difference between the price at which a market maker will sell "ask", or "offer" to a wholesale customer and the price at which the same market-maker will buy "bid" from the same wholesale customer is minimal, usually only 1 or 2 pips. This, of course, forex explained, does not apply to retail customers.

Most individual currency speculators will trade using a broker which will typically have a forex explained marked up to say pips so in our example 1. The brokers are not regulated by the U.

Securities and Exchange Commission since they do not sell securitiesforex explained, so they are forex explained bound by the same margin limits as stock brokerages. Individual forex explained speculators can work during the day and trade in the evenings, taking advantage of the market's 24 hours long trading session. If you want to know more about how to start trading in Forex, please proceed to our free Forex course article.

MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Forex explained Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service. Up to USD. Please disable AdBlock or whitelist EarnForex, forex explained.

Thank you! EarnForex Education, forex explained.

Investing Basics: Forex

, time: 7:20What Is FOREX? - Forex Explained, Forex Basic Information

Forex traders buy and sell different currencies 24 hours a day, 6 days a week, and access increased leverage (purchasing power) in order to speculate on global currency flows and market volatility. The Foreign Exchange market is commonly referred to as Forex or FX, and it is a worldwide, decentralised, over-the-counter financial market for the trading of currencies /4/28 · FOREX Explained - YouTube. This a video explaining what forex is and how I got started in the trillion dollar market I hope everyone enjoys. if you're interested hit my dm on insta Author: Frosty-T /12/20 · The foreign exchange market allows large institutions, governments, retail traders and private individuals to exchange one currency for another Estimated Reading Time: 8 mins

No comments:

Post a Comment