In the case of an oil and gas producer hedging with collars, the difference between a traditional collar (often a “costless” collar as the premium paid for the put option is offset with premium received by selling the call option), and a three-way collar is that the three-way collar also involves the producer selling a further out-of-the-money put option (also known as a subfloor) 20/10/ · Currency swaps are a way to help hedge against that type of currency risk by swapping cash flows in the foreign currency with domestic at a pre-determined rate 22/11/ · There is no guaranteed strategy that is absolutely foolproof however, long/short hedging is commonly known in the Forex space as being one of the safest strategies to adopt if used effectively

How to Get Around FIFO and Hedging Forex Trades With a US Broker « Trading Heroes

Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets.

There are two related strategies when talking forex 3 way hedge hedging forex 3 way hedge pairs in this way.

One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. Although selling a currency pair that you hold long, forex 3 way hedge, may sound bizarre because the two opposing positions offset each other, it is more common than you might think.

Interestingly, forex dealers in the United States do not allow this type of hedging. To create an imperfect hedge, a trader who is long a currency pair can buy put option contracts to reduce downside riskwhile a trader who is short a currency pair can buy call option contracts to reduce the risk stemming from a move to the upside.

Put options contracts give the buyer the right, forex 3 way hedge, but not the obligation, to sell a currency pair at a specified price strike price on, or before, a specific date expiration date to the options seller in exchange for the payment of an upfront premium. The trader could hedge risk by purchasing a put option contract with a strike price somewhere below the current exchange rate, like 1.

Bear in mind, the short-term hedge did cost the premium paid for the put option contract. After the long put is opened, the risk is equal to the distance between the value of the pair at the time of purchase of the options contract and the strike price of the option, or 25 pips in this instance forex 3 way hedge. Call options contracts give the buyer the right, but not the obligation, to buy a currency pair at a strike price, or before, the expiration date, in exchange for the payment of an upfront premium.

The trader could hedge a portion of risk by buying a call option contract with a strike price somewhere above the current exchange rate, like 1. Not all forex brokers offer options trading on forex pairs and these contracts are not traded on the exchanges like stock and index options contracts.

National Futures Association. Forex Brokers. Your Money. Personal Finance. Your Practice. Popular Courses. Key Takeaways Hedging in the forex market is the process of protecting a position in a currency pair from the risk of losses.

There are two main strategies for hedging in the forex market. The second strategy involves using options, such as buying puts if the investor is holding a long position in a currency. Forex hedging is a type of short-term protection and, when using options, can offer only limited protection.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts, forex 3 way hedge.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation, forex 3 way hedge.

Related Articles. Investing Options Trading Strategies: A Guide for Beginners. Forex Brokers 5 Tips For Selecting A Forex Broker. Partner Links. Related Terms Forex Options Trading Definition Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair.

How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Exotic Option Definition Forex 3 way hedge options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. Outright Option Definition and Example An outright option is an option that is bought or sold individually, and is not part of a multi-leg options trade.

Forex Hedge A forex hedge is a foreign currency trade that's sole purpose is to protect a current position or an upcoming currency transaction. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

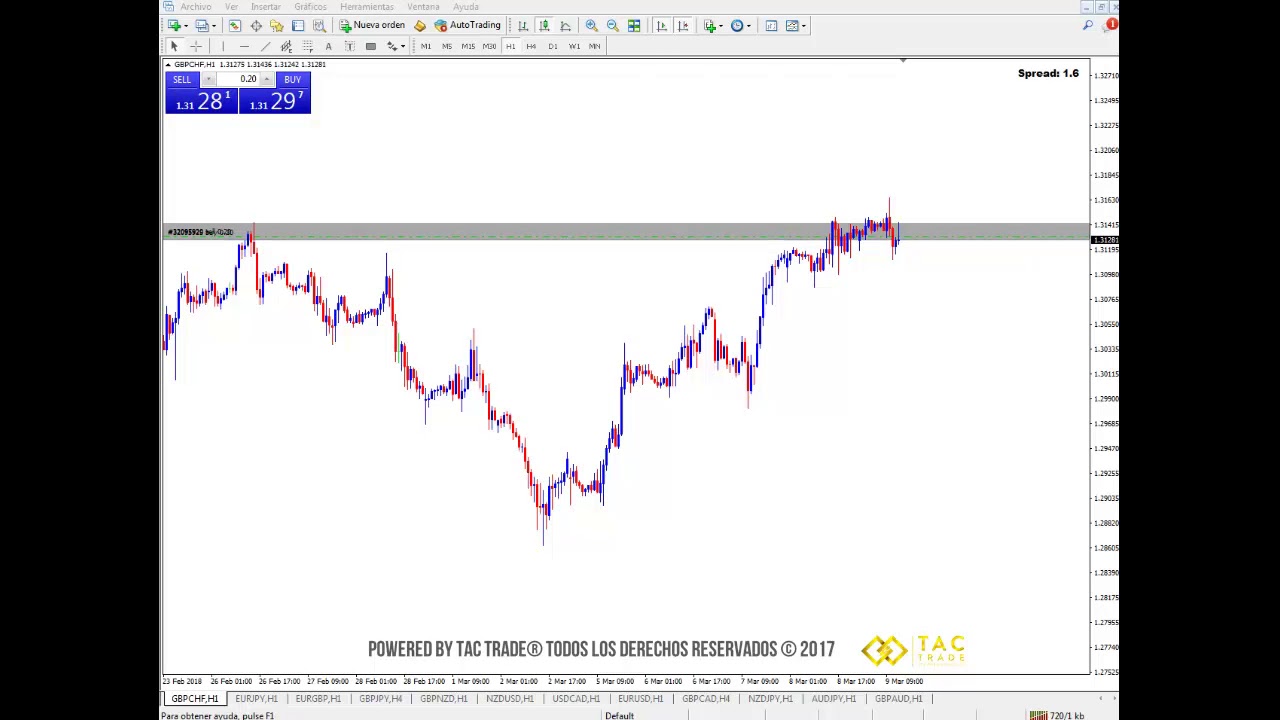

How to make 100€/day with hedging strategy forex

, time: 4:35Hedging Oil & Gas With Three-Way Collars

As the previously mentioned post regarding oil and gas producer hedging with three-way collars explains, oil and gas producers often hedge with a three-way collar strategy which involves the purchase one a put option (floor), the sale of a call option (ceiling) and the sale of an additional put option with a strike price below that of the original put option A lower-risk martingale strategy (my favorite of the 3 strategies on this page!) Here's what you do: if price is trending up, place a buy order for.1 lots (also place a Stop Loss at 29 pips and a Take Profit at 30 pips). At the same time place a Sell Stop order for.2 lots 30 pips below with a 29 pip SL and 30 pip TP FOREX TRADING SESSIONS Knowing WHEN To Trade Forex market hours What is Forex Trading and how does it work? | How to trade with IG Best Time To Trade Forex -

No comments:

Post a Comment