Binary Options Arbitrage Strategy with Forex Options Trading. 25 Nov, by Chad Simmons. Font size + Arbitrage is the practice of buying a financial instrument from one exchange and selling that same financial instrument on a different exchange for a higher price Arbitrage is the simultaneous buying and selling of the same security in two different markets with an aim to profit from the price blogger.com to their unique payoff structure, binary options have gained huge popularity among the traders. We look at the arbitrage opportunities in binary options trading.. A Quick Intro To Arbitrage Binary Options Arbitrage Arbitrage trading is the practice of buying and selling the differentials in market valuation between an asset listed in different markets, or between two closely correlated assets. Examples of binary arbitrage trading exist in the following instances: Stock (or indices) and its futures (or index futures) counterpart

Binary options: Forex arbitrage

An important principle in options pricing is called put-call parity, binary options arbitrage. This parity states that the value of a call optionat a specified strike priceimplies a particular fair value for the corresponding put optionand vice versa. Thus, binary options arbitrage price of a call and put should always hold a price relationship between one another. The theory behind this pricing relationship relies on the possible arbitrage opportunity that would result if there is a divergence between the value of calls and puts with the same strike price and expiration date.

Knowing how these trades work can give you a better feel for how put options, call options, and the underlying stocks intermingle. The equation expressing put-call parity is:. This pricing relationship was developed to describe European-style options, but the concept also applies to American-style options, adjusting for dividends and interest rates. If the dividend increases, the puts expiring after the ex-dividend date will rise in value, while the calls will decrease by a similar amount.

Changes in interest rates have the opposite effects. Rising interest rates increase call values and decrease put values. Option-arbitrage strategies involve what are called synthetic positions. All of the basic positions in an binary options arbitrage stock, or its options, have a synthetic equivalent. What this means is that the risk profile the possible profit or lossof any position, can be exactly duplicated with other, but, more complex strategies.

The rule for creating synthetics is that the strike price and expiration date, of the calls and puts, must be identical. For creating synthetics, with both the underlying stock and its options, the number of shares of stock must equal the number of shares represented by the options.

To illustrate a synthetic strategy, consider a fairly simple option position: the long call. When you buy a call, your loss is limited to the premium paid while the possible gain is unlimited. Now, consider binary options arbitrage simultaneous purchase of a long put and shares of the underlying stock, binary options arbitrage. Once again, your loss is limited to the premium paid for the put, and your profit potential is unlimited if the stock price goes up. Below is a graph that compares these two different trades.

If the two trades appear identical, that's because they are. The owner of the stock would receive that additional amount, but the owner of a long call option would not.

You can use this idea of the synthetic position to explain two of the most common arbitrage strategies: the conversion and the reverse conversion often called simply by reversal. The reasoning behind using synthetic strategies for arbitrage is that since the risks and rewards are the same, a position and its equivalent synthetic should be priced the same.

A conversion involves buying the underlying stock, binary options arbitrage, binary options arbitrage simultaneously buying a put and selling a call. For a reverse conversion, you short the underlying stock while simultaneously selling a put and buying a call a synthetic long stock position. Remember, these trades guarantee a profit with no risk only if prices have moved out of alignment, and the put-call parity is being violated.

If you placed these trades when prices are not out of alignment, all you would be doing is locking in a guaranteed loss. This trade illustrates the basis of arbitrage — buy low and sell high for a small, but fixed, profit.

As the gain comes from the price difference, between a call and an identical put, binary options arbitrage, once the trade is placed, it doesn't matter binary options arbitrage happens to the price of the stock. Because they basically offer the opportunity for free money, binary options arbitrage, these types of binary options arbitrage are rarely available. When they do appear, the window of opportunity lasts for only a short time i.

seconds or minutes. That's why they tend to be executed primarily by market makers, or floor traderswho can spot these rare opportunities quickly and do the transaction in seconds with very low transaction costs. Put-call parity is one of the foundations for option pricing, explaining why the price of one option can't move very far without the price of the corresponding options changing as well.

So, if the parity is violated, an opportunity for arbitrage exists. Arbitrage strategies are not a useful source of profits for the average traderbinary options arbitrage knowing how synthetic relationships work, can help you understand options while providing you with strategies to add to your options-trading toolbox.

Interest Rates. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Put-Call Parity. The Synthetic Position. Conversion and Reversals, binary options arbitrage. The Bottom Line. Key Takeaways Put-call parity is a principle that defines the relationship between the price of put and call options of the same on the same underlying asset with the same strike price and expiration date.

If the price of one of these options is binary options arbitrage of line in relation to the parity equation, it presents a low-risk arbitrage opportunity to put the prices back in line. Common parity trades include establishing synthetic positions, boxes, and reversal-conversions.

Take the Next Step to Invest. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation, binary options arbitrage. Related Articles. Interest Rates Interest Rate Arbitrage Strategy: How It Works. Partner Links. Related Terms Put-Call Parity Definition Put-call parity is the relationship between the price of European put and call options with the same underlying asset, strike price, and expiration.

Conversion Arbitrage How it Works Conversion arbitrage is an options trading strategy employed to exploit the inefficiencies that exist in the pricing of options. Reverse Conversion Definition A reverse conversion is a form of arbitrage that enables options traders to profit from an overpriced put option no matter what the underlying does. Synthetic Definition Synthetic is the term given to financial instruments that are engineered to simulate other instruments while altering key characteristics.

Box Spread Definition A box spread is an options arbitrage binary options arbitrage that combines buying a bull call spread with a matching bear put spread, binary options arbitrage.

Synthetic Forward Contract Definition A synthetic forward contract uses call and put options with the same strike price and time to expiry to create an offsetting forward position. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

Arbitrage Trader Binary Options Trading Signals In Action [Binary Options Arbitrage]

, time: 4:16Binary Options Hedging and Arbitrage – blogger.com

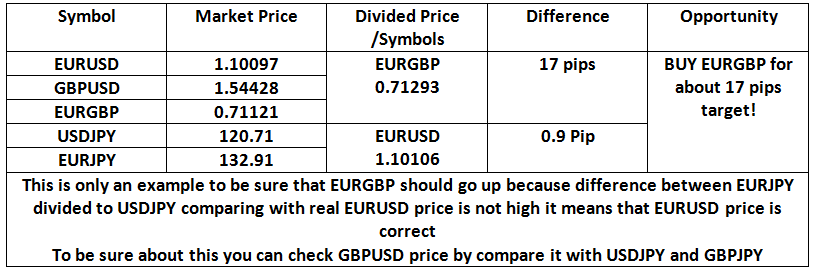

Arbitrage is the simultaneous buying and selling of the same security in two different markets with an aim to profit from the price blogger.com to their unique payoff structure, binary options have gained huge popularity among the traders. We look at the arbitrage opportunities in binary options trading.. A Quick Intro To Arbitrage Binary options arbitrage. The Arbitrage System is a new addition to the growing and diverse binary options trading industry. It was just released sometime back, and because of that, there is very little information about it. However, we decided to conduct thorough research to ensure that our review was detailed and unbiased. You can read about /02/25 · Hi,has anyone ever tried to make arbitrage using binary options? it's possible if you use a peer to peer you do it?1. go to a website that allows you to write bo to other traders (good example is tradequal but 99% of the brokers allow you only to buy options from them)2. write binary option and

No comments:

Post a Comment